Key Takeaways

- Off road fuel tax credit helps recover federal taxes on off-highway fuel use.

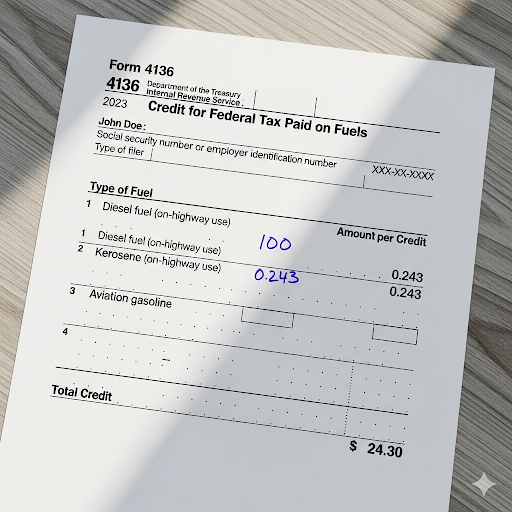

- Form 4136 fuel tax credit is used to claim these credits on your tax return.

- Proper documentation of fuel usage is essential to qualify.

- Off road diesel fuel tax credit and red diesel fuel tax credit have specific eligibility requirements.

- Tools like the fuel tax credit calculator can estimate potential refunds.

Table of Contents

Off Road Fuel Tax Credit

If you use vehicles or equipment that uses fuel in non-highway applications or you have a business that uses fuel off the highway, you can claim back federal taxes paid on fuel. These credits will particularly serve operators in industries like agriculture, construction, mining and landscaping where a lot of fuel is used off-road. If you’re eligible, you can use IRS FORM 4136 to claim the federal tax on fuels credits. This will reduce your operational expenses.

If you make any improper claims while trying to claim the credit for federal tax paid on fuels, this could cause you to get audited, so it is crucial to understand how it works. You should check your eligibility before filing in order to benefit from all refundable amounts.

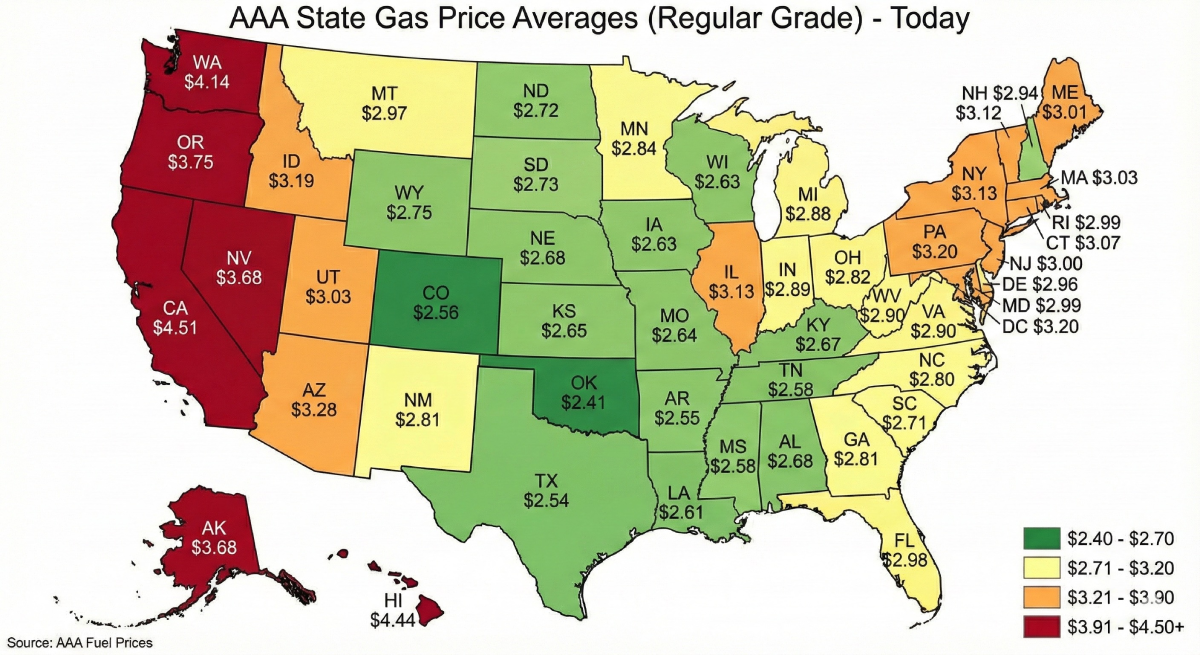

Off Road Fuel Tax Credit Rate

The off-road tax isn’t fixed, it depends on the fuel type and how it is used.

- The federal credit for gasoline used off-road is usually $0.184 per gallon which is equal to the excise tax.

- For diesel, the federal credit is $0.244 per gallon. Diesel’s federal credit is subject to adjustments such as

The total refundable amount on fuel used off-road can be affected by fuel blends, alternative fuel tax credit rate and the type of off-road activity in which the fuel was used.

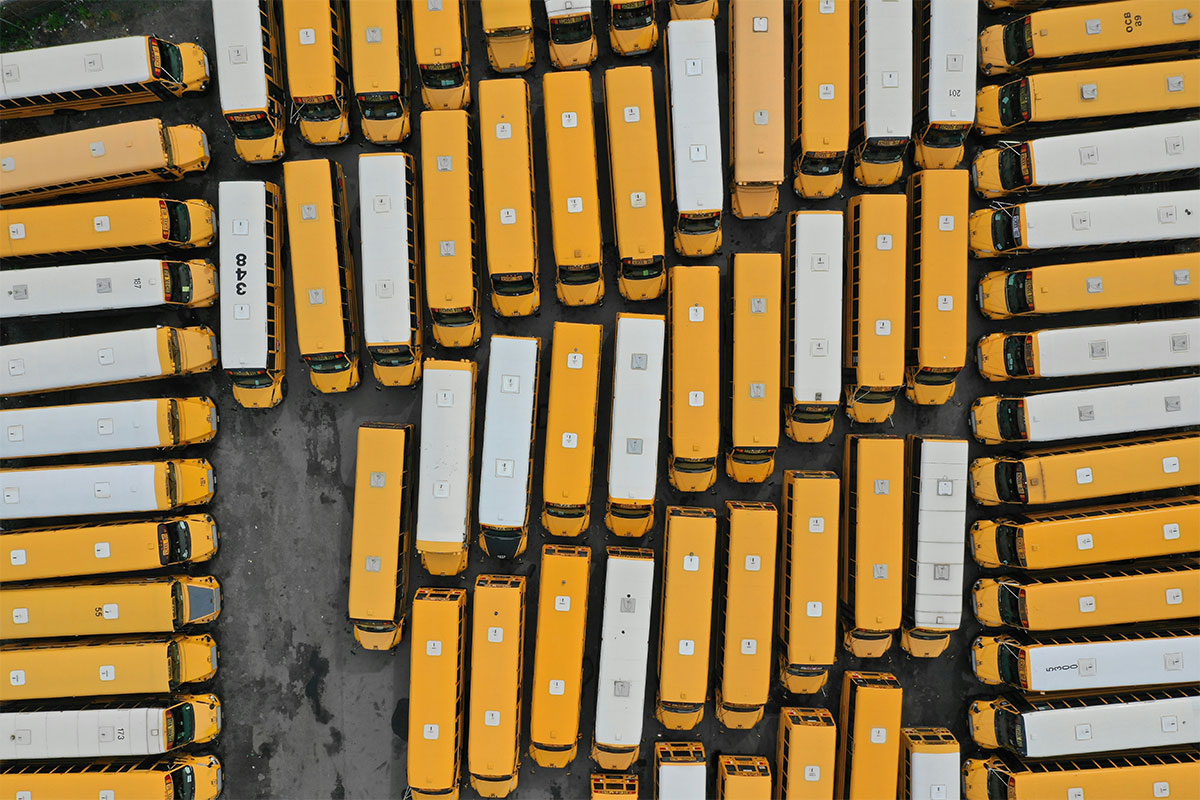

Typically, fleet operators in agriculture and construction benefit the most refunds as they have the most off-road activities needing fuel used.

Understanding fuel tax credit for off-road use makes you remain compliant while reducing operational cost. So you have to always teach usage and keep good records of your purchases in order to maximize your refunds.

Missing Out on Off-Road Fuel Refunds?

Every gallon used off-highway could mean money back in your pocket. Learn how to claim IRS Form 4136 correctly and avoid leaving cash on the table.

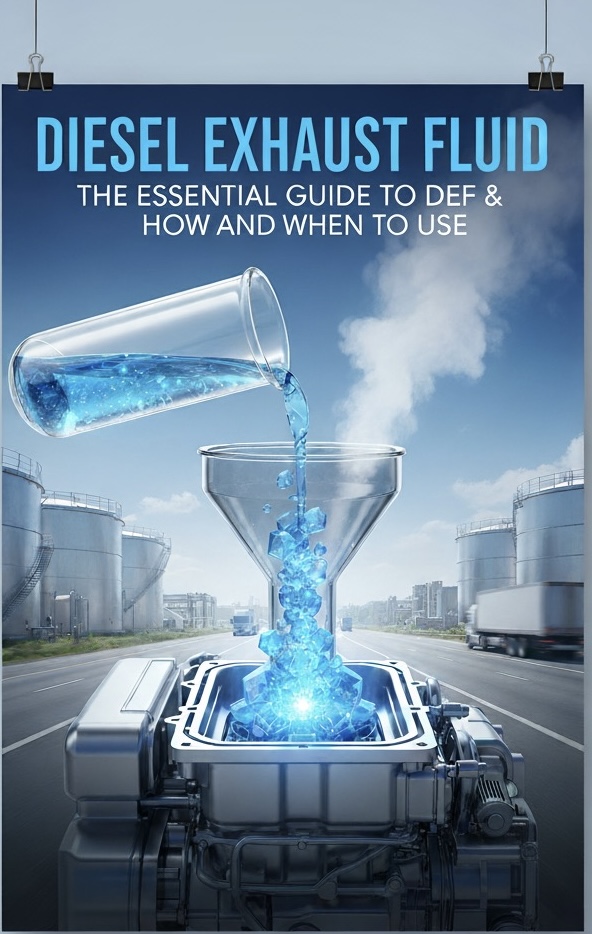

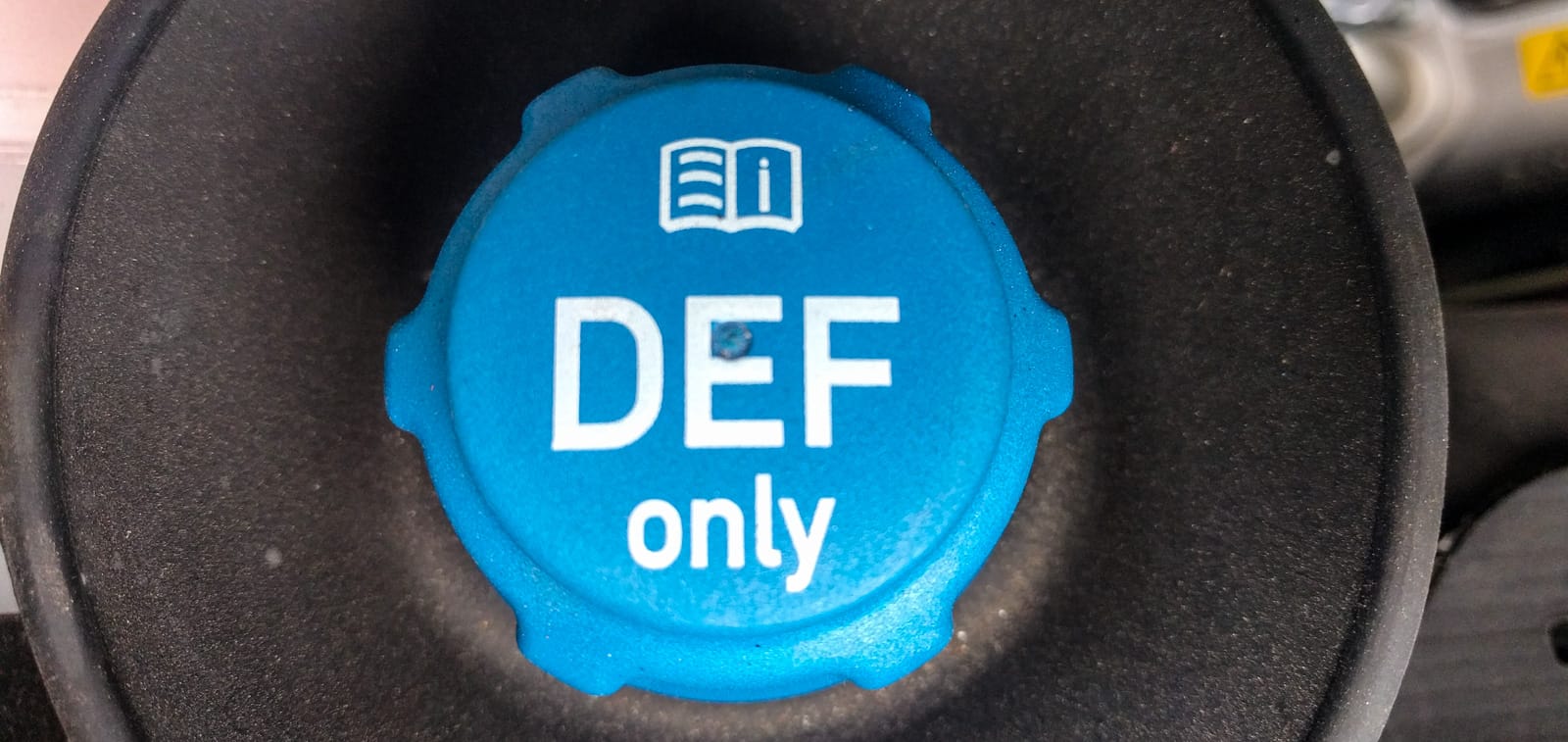

Off Road Diesel Fuel Tax Credit

The off-road diesel fuel tax credit is made for diesel fuel type that is used in off-road applications such as in tractors, construction equipment and generators. These qualify for the federal tax paid on fuels credit. In order to claim this, individuals or businesses must retain all their invoices and records of usage as evidence of off-road use of diesel. Credits apply to tax-paid, undyed (clear) diesel subsequently used for nontaxable purposes. Dyed (red) diesel is generally sold untaxed and therefore doesn’t generate a federal credit. Claiming the credit for federal tax on fuels often comes as a great benefit for farmers and construction fleet operators.

If the usage of diesel is not properly accounted for, your credits can be withheld and you can even have an IRS penalty. Make sure to stay compliant in order to maximize your refunds, avoid the risk of auditing and possible fines.

Fuel tax credits, including off-road diesel rates at codified in the 26 U.S.C. § 6427

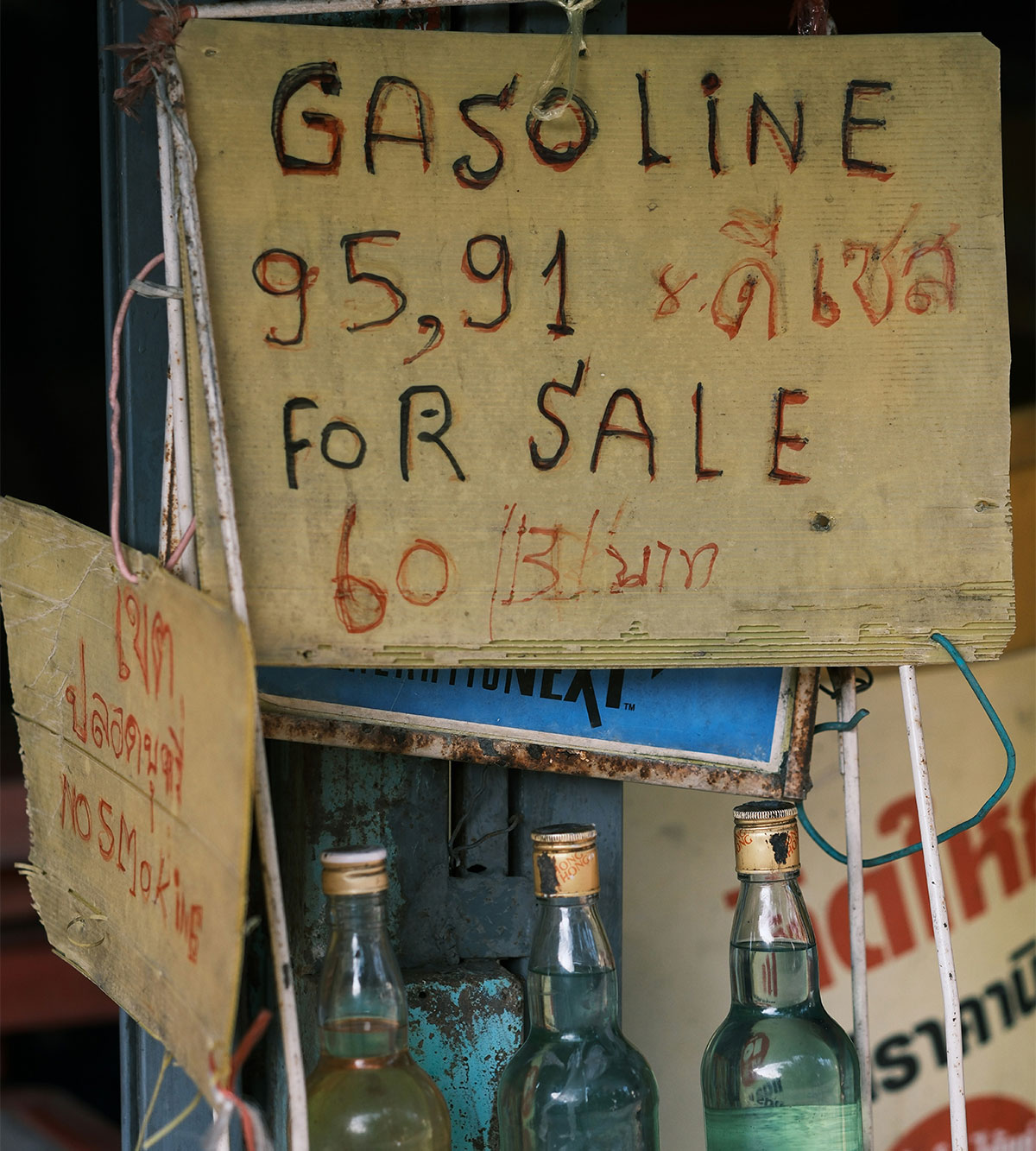

Off Highway Business Use Of Gasoline

When gasoline is used in operations out of the highways, it qualifies for non-taxable use of gasoline credit. This includes gasoline used in tractors, construction and other off-road uses. There are some mistakes that if made, will stop someone from claiming their refund. They include

- Filing claims for fuel used in vehicles that sometimes operate on public roads.

- Not keeping records of off-road usage of gasoline.

By claiming the gasoline tax credit, the operational cost of off-road equipment will drop. It should be noted that the credit for federal tax in gasoline and special fuels. But this will only apply when the gasoline was used in off-road applications. The IRS Form 4136 has details on nontaxable use of gasoline credit and it’s important for businesses to know this, stay compliant and benefit from the legal tax relief that exists.

Fuel Tax Credit Calculator

Fuel tax credit calculators are tools which exist to simplify your understanding of potential return. To have accurate calculations, they consider fuel type, volume and the off road fuel tax credit rate that is applicable. These calculations are very important in order to prevent over claiming or under claiming the credit for federal tax on fuels.

When using fuel credit calculators, accurate and detailed purchase records, receipts and usage logs should be imputed in order to ensure correctness. When you use the fuel tax credit calculator for your company you can forecast cash flow improvements and optimize fuel tax reporting, making sure they benefit fully from their federal tax credits.

Confused About Diesel vs. Gasoline Credits?

Not all fuels qualify the same way. Discover which rates apply to your business, how to handle red diesel, and what records you need to stay compliant.

Credit For Federal Tax Paid On Fuels

The credit for fuel tax paid on fuels permits taxpayers to recover some taxes paid on gasoline, diesel and all other fuels which are eligible. This includes off road fuel credit claims, you can reference the IRS Fuel Tax Credit FAQ to understand more. Whether it is gasoline, diesel or any other fuel alternative, it is subject to specific credit rates and taxpayers are obligated to comply with their rules when documenting and reporting information to claim credits.

If you use fuel in off road applications such as in farming, mining or construction you qualify for the ful tax credit for off road use. Accurately logged fuel usage and receipts are very crucial in the process of claiming the IRS credit for federal tax on fuels and ensure compliance with federal tax on fuels credit requirements

Credit For Federal Tax On Fuels Instructions

To understand the credit for federal tax on fuel and their instructions, reference the table below;

| Category | Information |

|---|---|

| Form used | IRS Form 4136 on fuel tax credit |

| Eligible efuels | Gasoline, diesel and alternative fuels |

| Uses that qualify | Off highway operations such as those in construction, agriculture and mining. |

| Credit rates | Varies between the different types of fuels |

| Documentation | Logs, receipts and all fuel usage recordings must be kept. |

| Key compliance | All IRS federal tax on fuel credit requirements have |

Want to Maximize Your IRS Fuel Tax Credit?

With the right documentation and strategy, you can boost cash flow and cut costs. Use calculators, avoid common mistakes, and capture every credit you deserve.

Nontaxable Use Of Gasoline Credit

When gasoline is used in off road applications for construction, agriculture and mining, the non-taxable use of gasoline credit applies. But to claim this fuel tax credit, you must properly document your usage of gasoline in off road application. According to the IRS, eligibility for non-taxable use of gasoline credit is dependent on off-road activity. Understanding the rules guiding non-taxable gasoline can help you capture savings, enhance your cash-flow and avoid legal and compliance issues.

On Road Fuel Tax Credit

The on-road fuel tax credits are different from the off-road credits but they are relevant when considering vehicles with month on-road and off-road use. While the fuel tax credits are mostly applicable for off-highway applications,the fuel tax credit (Form 4136) is for nontaxable uses. Fuel used to propel vehicles on public highways is taxable and generally not credit-eligible. Mixed-use claims apply only to the off-highway portion; business income-tax deductions are separate concepts.

To be able to claim the federal tax paid on fuels (2023) fuel usage between highway and off-highway has to be apportioned properly. To ensure compliance and to get the best benefit from fuel tax relief, it is crucial to understand the differences between on-road fuel tax credit and off-road fuel tax credit.

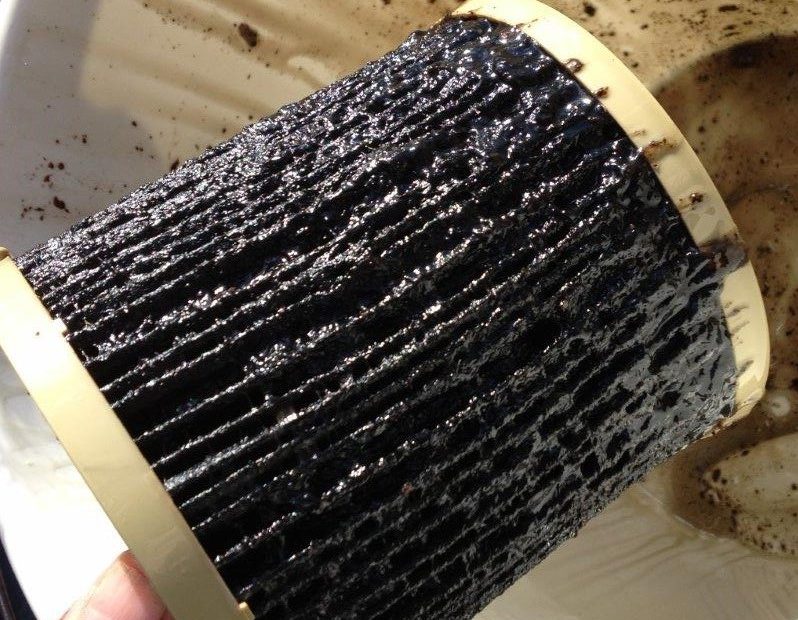

Red Diesel Fuel Tax Credit

Red diesel fuel tax credit is applicable to dyed diesel that is used in off-road activities such as farming and construction. Red diesel, by definition, is exempt from highway excise taxes, so it doesn’t have any more fuel tax credits. To take advantage of this, businesses have to accurately log their usage, document purchases and keep all invoices in tact.

If any tax free diesel such as red diesel is used on public roads, it will lead to fines and even criminal charges in some regions. If your business is in farming, construction or mining, your records, if properly kept, can qualify you for the credit for federal tax paid on fuels 2021 and the years after.

Form 4136 Fuel Tax Credit

Form 4316 which has been referenced in this article severally is an IRS form used by businesses and individuals to claim off-road fuel tax credit and other fuel tax refunds. In order to use Form 4136, the taxpayers have to provide details such as fuel type, quantity and non-taxable use of gasoline. Also follow the following steps;

| Step | Action | Where on Form 4136/What to put in | Documents to have | Tips/Common Mistakes to look out for |

|---|---|---|---|---|

| 1 | Go to IRS.gov and download the latest version of Form 4136 | No entries yet | PDF of Form 4136 and instruction booklet | Rates, statements and instructions can change yearly. Always download the most recent version of the form |

| 2 | Gather all your records including invoices, fuel card statements, suppliers names/addresses, dates, gallons consumed and equipment logs. | Columns B for gallons and D for Amount of credit (found on line 1-16) | Original receipts, bills of lading, fuel card exports and equipment usage logs. | Make sure gallons on the invoices and those reported match. Report on-road and off-road gallons separately. |

| 3 | Identify each type of fuel and their qualifying use | Make sure you enter information on the correct lines, for example lines 1–5 for gasoline/diesel, lines 10–12 for biodiesel/alt fuels | Fuel labels, blend certificates, dye/undyed confirmations | Use the IRS rates table and enter each fuel type on its proper line. |

| 4 | Compute the credit (gallons × the rate for that line/type) | On column D of each line, also include credit reference number in column E if required. | Computation worksheet (per fuel type). | Attach the Statement Supporting Fuel Tax Credit Computation-1 if required. |

| 5 | Complete all applicable lines (1–16), then put total credit on line 17 | Fill columns A–D per line with the total on line 17 | Completed Form 4136 with per-line entries. | Double-check totals. Incorrect rates are the most common cause of disallowance |

| 6 | Include special registrations/certificates if required (Form 637, biodiesel/SAF certificates, reseller statements). | Enter registration numbers where prompted. | Form 637, certificates, blender statements, registered card issuer docs | Without Form 637 (if required), you cannot claim certain credits |

| 7 | Attach Form 4136 and any statements to your federal tax return. | Carry line 17 total to the proper return line (Form 1040 Sch 3, Form 1120 Sch J, etc. | Completed Form 4136 and return | Ensure Form 4136 is attached to avoid processing delays. |

| 8 | Review declaration language and sign the tax return | Certification at top of Form 4136 and signature on tax return | Signed tax return or e-file acknowledgment | Retain all backups. A penalty of perjury applies if filing is inconsistent with records. |

| 9 | Keep records to substantiate the claim. | Don’t file but retain it for audits. | Receipts, invoices, computations, telematics, reseller certificates | Retain at least 3 years from return due date. |

| 10 | Final pre-file checklist: validate allocations, confirm attachments and reconcile to accounting. | Confirm line 17 carried correct information and statements attached. | Reconciliation worksheet tying gallons to ledger. | Avoid double reporting fuel, missing statements, or misallocating mixed-use gallons. |

Fuel Tax Deduction

The big difference between fuel tax credits and fuel tax deductions is that fuel tax credit reduces tax liability directly while fuel tax deductions reduce taxable income. For your business, compare which offers your more benefit depending on the fuel type you use and what you use it for.

Some deductible expenses are off-road diesel, gasoline for equipment and what is spent on alternative fuel credit expenditures.

When you fully understand the difference between credits vs deductions, you can fully capture the benefits of fuel tax relief without being non-compliant. Make sure to maintain documents such as fuel credit tax on return and all receipts as they are important for staying compliant and maximizing savings.

Alternative Fuel Tax Credit

The alternative fuel tax credit is a tool to encourage the use of cleaner fuel alternatives in off-road operations. The fuel types that can benefit from this credit are biodiesel, ethanol blends and natural gas. Keeping proper records if fuel type uses, volume and off-road operation used for is necessary.

For businesses, this credit can help them reduce their expenses while helping to achieve the environmental goals set by the federal government. Use alternative fuel credit 2023 effectively to maximize refunds and reduce cost of operations.

Diesel Fuel For Farm Use

If you run a farming business and use tractors which consume diesel or any other machines that consume diesel, you can claim the credit for tax paid on fuel. This isn’t the same as the off-road diesel fuel tax credit which is claimed when diesel consuming equipment is used off-road. The IRS permits farmers to obtain the diesel fuel for farm use credit from the credit for federal tax paid on fuels 2020 as part of operational cost management for the farms.

Properly complying ensures your farm business benefits fully from all available fuel tax relief. Make sure to keep all documents such as receipts and fuel logs.

Where To Claim Fuel Tax Credit

To claim fuel tax credits, use IRS Form 4136 fuel tax credit alongside your federal income tax return. The fuel types eligible for these returns are gasoline, diesel and alternative fuels used off-road.

The credit for federal tax on fuels 2023 can be processed with supporting documentation and equipment usage logs. Usually, the refunds are done within 21 days after filling. When businesses complete their Form 4136, the IRS can process funds efficiently. When businesses claim the off-road due tax credit properly, they maximize operational savings and increase cash flow management.

How To Maximize Fuel Tax Credits Off Highway Use And Limits

Follow the strategies below to maximize off-road fuel tax claims;

- Maintain detailed purchase records and usage logs

- Use a fuel tax credit calculator to correctly estimate refunds

- File your IRS Form 4136 fuel tax credit on time

- Claim all eligible fuel type credits including diesel, gasoline and alternative fuels

- Monitor IRS updates to credit for federal tax on fuels 2024.

If you follow these strategies , your business will reduce costs, ensure compliance and tax full advantage of fuel tax relief initiatives