Key Takeaways

- Off-road diesel is taxed differently from on-rod diesel

- It is illegal to use off-road diesel in farm trucks when it is used on public highways

- Anyone can buy dyed diesel but it is not to be used on public roads

- Removing fuel dye is illegal and carries heavy penalties

- Government agencies test tanks for traces of red diesel during inspections.

Table of Contents

Why Is Off-Road Diesel Illegal

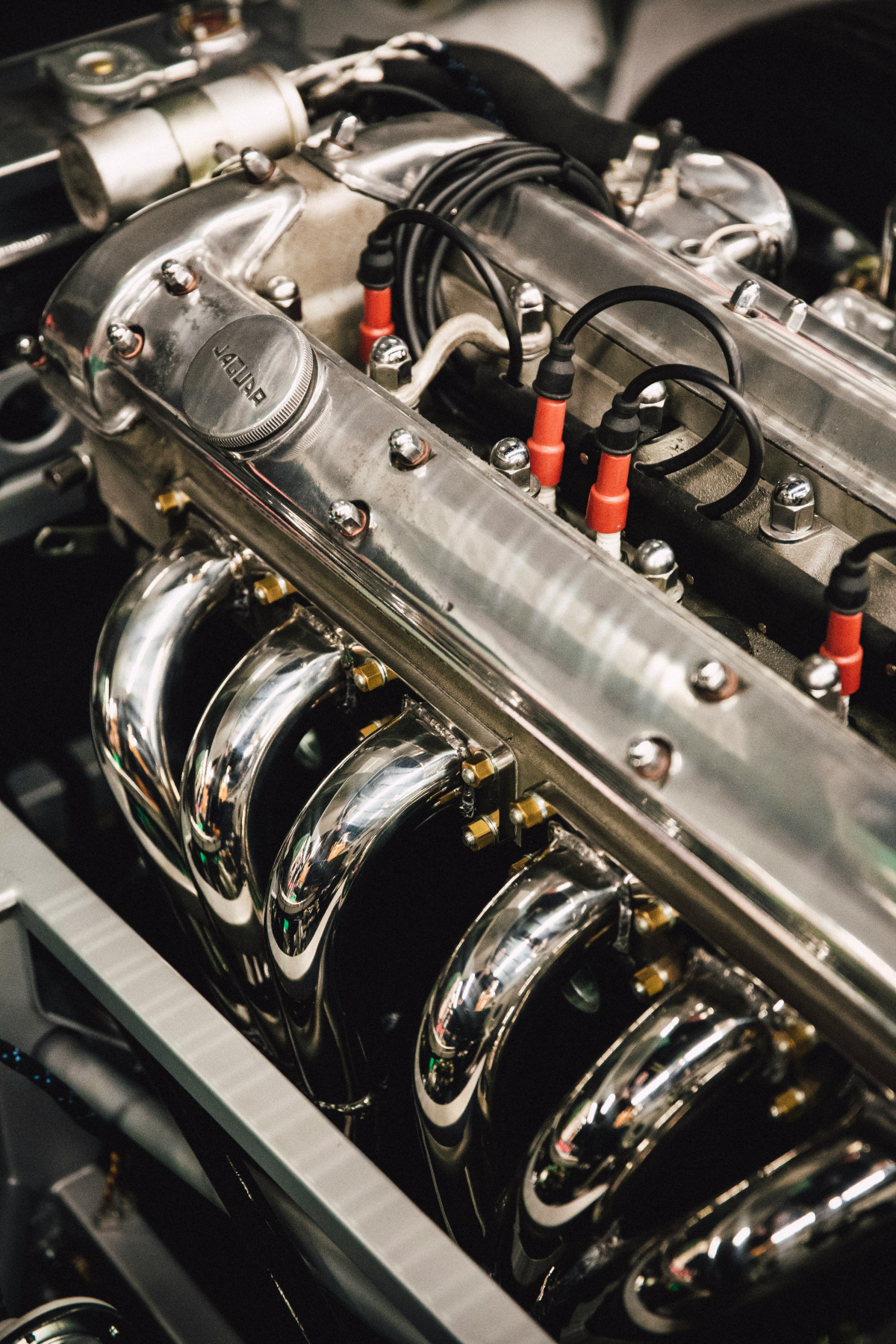

The reason for the illegality of off-road diesel is primarily taxation. Since the government relies on revenue from taxes to fix roads and maintain them, fuel is usually taxed in order to fund the road infrastructure. Given that off-road diesel is intended to be used away from public roads in tractors, generators and construction machines, it is exempt from road-use taxes. This is also why off-road diesel is dyed red, to make it easier to pick out

Another reason why red diesel is illegal is because some people may want to cut corners and use off-road diesel on public roads there by undermining state and federal budgets. There may also be environmental concerns as some off-road engines do not meet the standards of road vehicles. Agencies like the IRS and state tax revenue bodies are in charge of monitoring compliance and enforcing the regulations involved. Using red diesel on the highway or on public roads is not a minor violation, it is considered tax evasion. Make sure to understand the difference between regular diesel and red diesel in order to avoid violating any regulations.

Can Anyone Buy Off-Road Diesel?

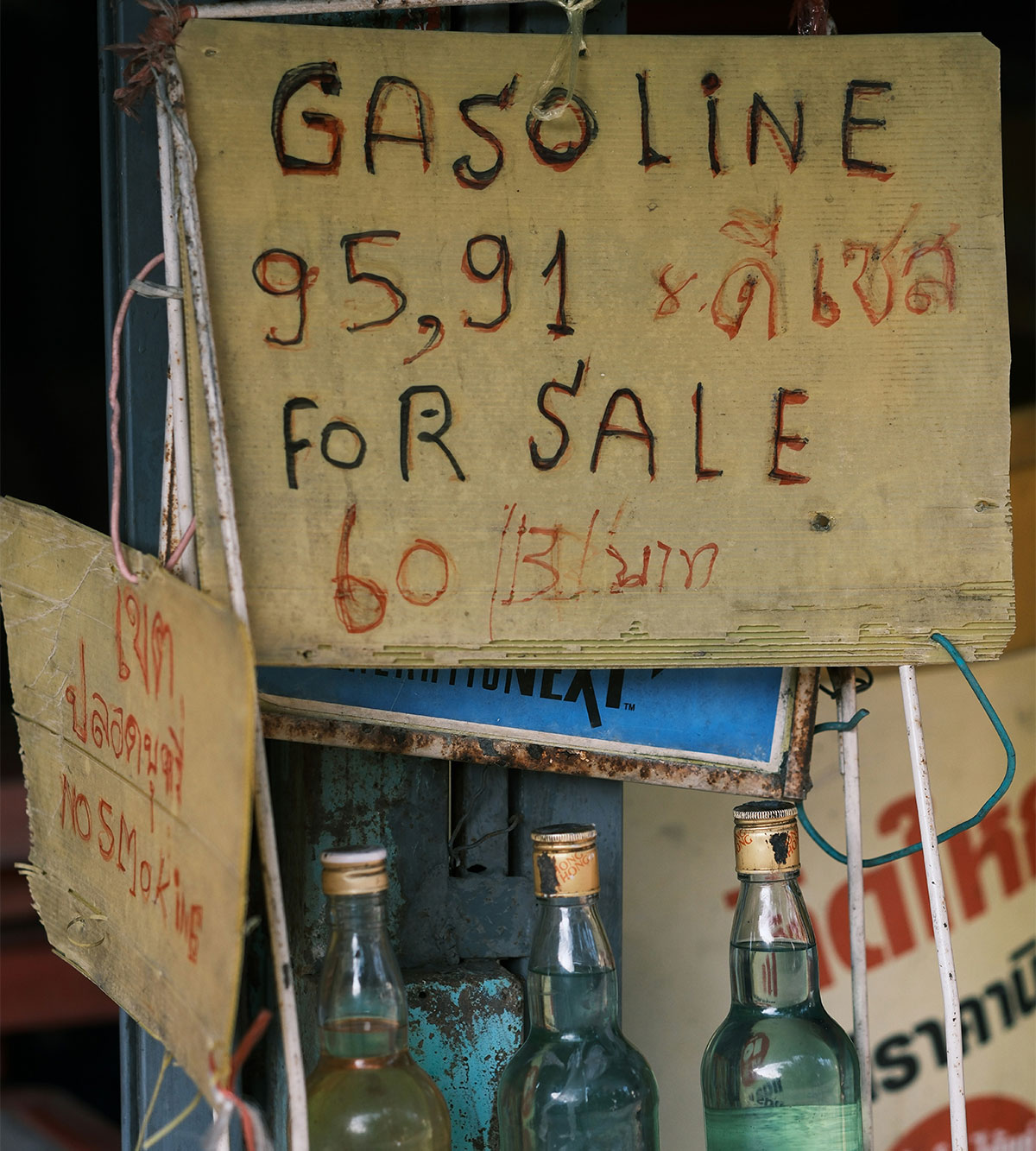

If you’re wondering, can anyone buy off-road diesel, well, the simple answer is “yes”. Red diesel is open to distributors who buy it and distribute it. However, in many states, you need a permit or license to buy red diesel. But, its peculiar nature is not relevant in its purchase but in its use. For farmers, contractors in construction and mining fleet operators, red diesel is their go-to fuel type as it is compatible with their activities

In some states, people or businesses seeking to buy large quantities of red diesel have to present some documentation, especially if the business or individual is claiming tax exemptions.

Using Red Diesel In A Farm Truck? Know When It’s Allowed

Most highway driving with dyed fuel is illegal, but narrow farm-use exceptions may apply for short trips between fields. Learn what counts, what paperwork to keep, and how to stay compliant.

Why Is Red Diesel Not Taxed?

The government doesn’t tax red diesel for the following reasons

- Fairness: Given that the users of off-road diesel use it away from public transit pads and on-road diesel is taxed for the sake of revenue to maintain the roads, it’s only fair that those who don’t use the public roads

- Incentive to industries: As a way to incentivize production in some industries and make production cheaper, red diesel is not taxed.

This policy keeps some industries like agriculture , construction and mining competitive by making their overall operational costs lower. However, given the price gap between taxed and in-taxed diesel, the tax agencies have to remain alert because there’s sufficient incentive for farm trucks and other vehicles to seek to use red diesel.

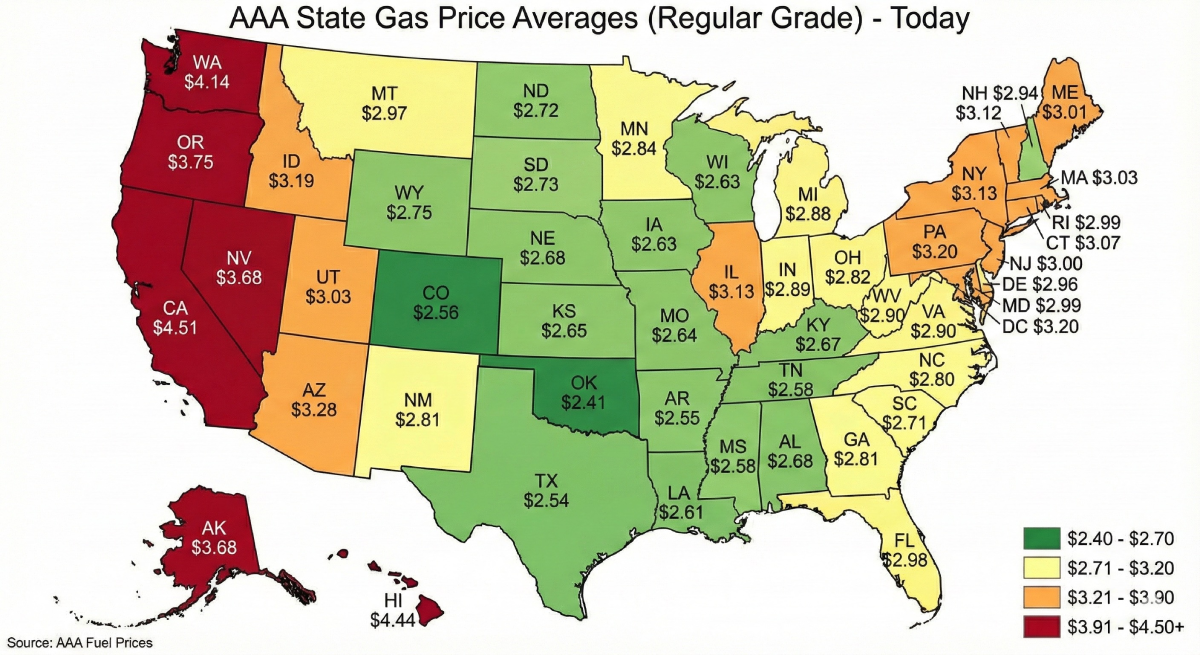

Why Is Off-Road Diesel Cheaper?

The core reason why off-road diesel is cheaper is taxation. Given that dyed diesel is exempt from road-use taxes, a gallon may be 25-40cents or sometimes even up to 59cents lesser than regular diesel. This helps farmers, construction and mining fleet operators save a lot in operating cost yearly.

Cheaper pricing helps reduce operational costs to support crucial industries. With the amount of fuel needed in some off-road activities such as agriculture, a farmer filling a 200 gallon tractor saves a lot of money because they’re not forced to use regular diesel. Unfortunately, some people try to use off-road diesel in farm trucks that drive on public roads too. This opens them up to heavy fines and even criminal charges for tax evasion. The enforcement of red diesel on public roads is very strict.

Worried About Penalties For Dyed Diesel?

Fines can reach $1,000 or $10 per gallon and roadside testing can detect even trace amounts from past fills. See the common violations and the simple steps that keep you out of trouble.

Can You Run Red Diesel In A Farm Truck?

The question “can you run red diesel in a farm truck” is quite popular and the straightforward answer is; in some circumstances. If the farm truck never leaves your farm grounds, it is very okay to run it on red diesel. However, if that truck goes on a public road, it requires on-road diesel.

In some states, there are exemptions that permit farm trucks running on red diesel to be on public roads. For example, short trips for agricultural purposes like crossing a road between two fields. But generally, driving a farm truck running on dyed diesel is illegal. To make sure this is being respected, law enforcement and tax agencies routinely check the rural areas for compliance since farmers are the largest users of off-road diesel. If you use your farm truck on public roads, make sure to only use taxed diesel to avoid fines and penalties.

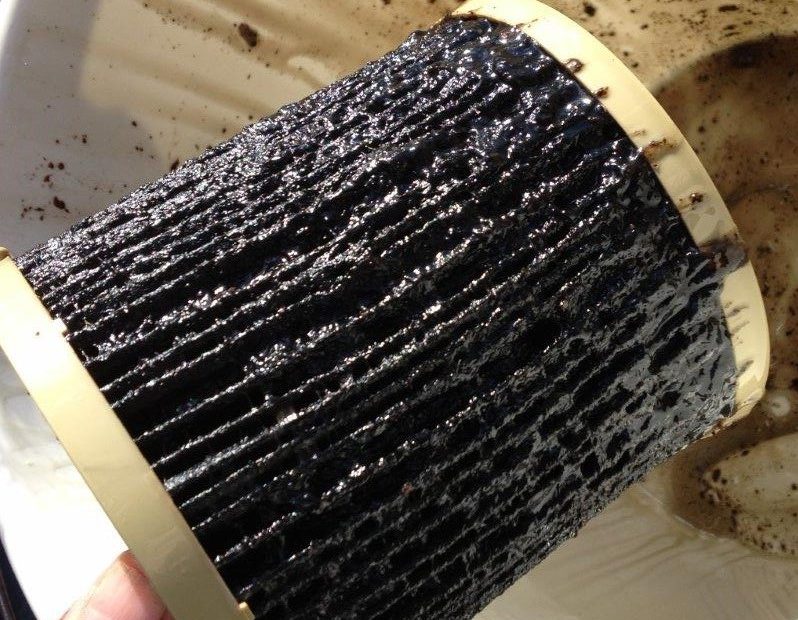

Why Do People Remove Dye From Diesel?

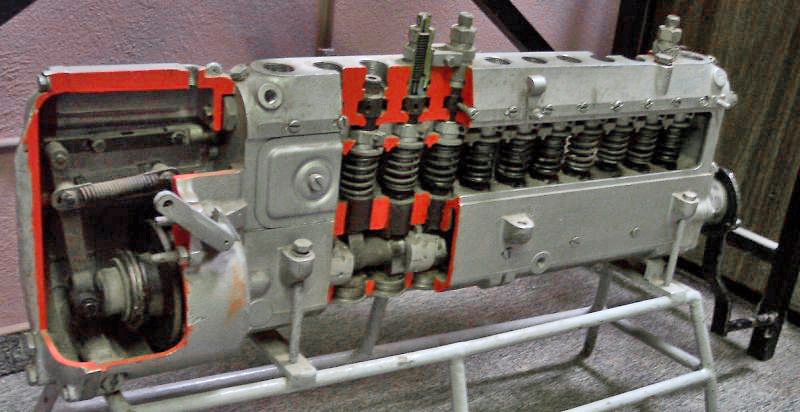

People sometimes remove the dye from their red diesel, this is usually referred to as “fuel laundering”. They do this in order to pass red diesel which they purchase for cheaper as road legal fuel. Criminals use chemicals or filters to remove the red dye from the fuel.

However, law enforcement agencies can still use chemical tracers to determine if red dye was once present in fuel. They use chemical tests to check for this during roadside tests. Removing the dye from red fuel is considered a graver crime than driving in a public road with red diesel, it is considered tax fraud. Apart from legal trouble, you can also get into mechanical issues as the filters used to remove red dye from fuel are often corrosive so they may lead to engine damage.

Penalties For Using Off-Road Diesel Illegally

The following punishments can be implemented if you’re found using diesel illegally

- Fines of up till $1000 or $10 per gallon of untaxed dyed diesel found in your tank

- Your vehicle can also get impounded

- You may open yourself up to back tax assessment

- If you’ve been found repeated with red diesel on public roads, you will get criminal charges.

Other than federal fines and penalties, state tax officials may impose additional penalties that will cost you serious financial damage.

Note that compliance is cheaper than trying to launder fuel. So understand the regulations around red diesel and act accordingly.

Legal And Illegal Use Of Dyed Fuel

| Vehicle/Equipment | Legal Use of off-road diesel/red diesel | Illegal use of off-road diesel/red diesel |

|---|---|---|

| Tractors and Combines | Running exclusively in farm property with off-road diesel | Driving long distances on highways with red diesel |

| Bulldozers and excavators | Powering Machinery at construction sites using red diesel | Transporting machinery in public roads with off-road diesel |

| Generators | Backup power system legally fueled with red diesel | Using generators on mobile trailers that power vehicles with off-road diesel |

| Farm Trucks | Operates only within private farmland with red diesel | Driving on highways with dyed diesel in the tank |

| None | Any use of red diesel in a passenger vehicle is wrong. |

Planning To Buy Red Diesel? Do It The Right Way

Anyone can purchase dyed fuel, but usage rules are strict. Get a quick guide to legal off-road uses, storage and record-keeping so your equipment stays fueled and your trucks stay street-legal.

Acceptable Uses Of Tax-Exempt Fuel On Public Roads

While off-road diesel is illegal for most vehicles on highways, there are exceptions. Acceptable uses of tax-exempt fuel on public roads include emergency response vehicles, certain municipal operations, and agricultural vehicles under specific exemptions. For example, some jurisdictions allow a farm truck using dyed diesel to drive short distances between fields.

However, proof is often required. Farmers may need to show receipts, farm-use permits, or exemption documentation if stopped. These exceptions are narrow and closely monitored. The general rule remains: unless your vehicle falls into a documented exemption, driving on public roads with red diesel in the tank is illegal.

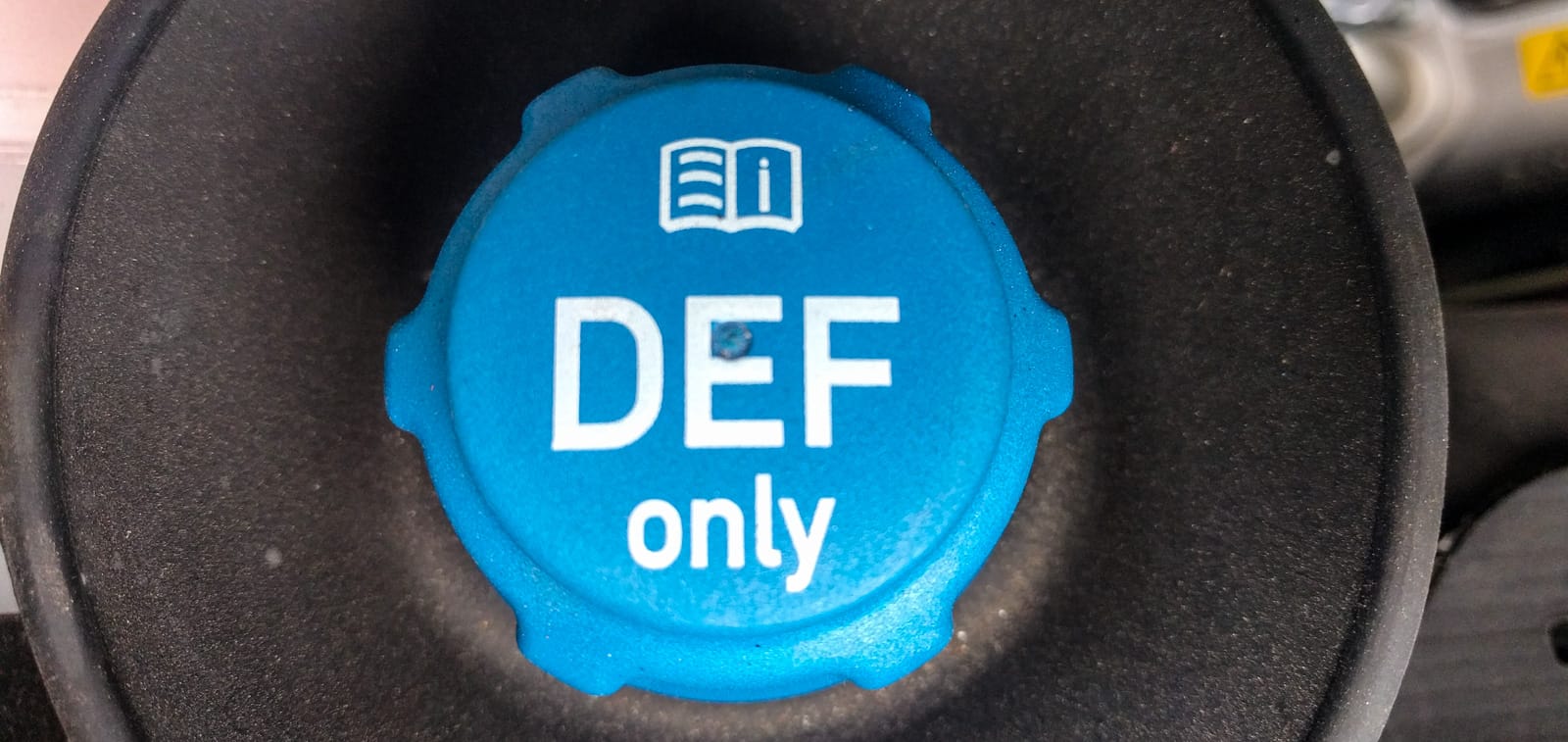

How Can The Government Test If Someone Used Dyed Fuel?

You might ask: how can the government test if someone used dyed fuel? Roadside inspections are the main method. Officers dip a probe into the tank to collect a fuel sample. If the sample reveals red coloring or chemical markers, the driver faces penalties.

Modern testing goes beyond visual inspection. Agencies use spectrographic analysis to detect even trace amounts of dyed diesel, meaning even a single tank of off-road diesel used months ago can still be detected. Farmers and truckers who think they can “use just one tank” of red diesel in their farm truck often learn the hard way that detection is nearly foolproof.