Key Takeaways

- The fine for using off-road diesel can be $1,000 minimum federally, plus state add-ons and taxes too

- A penalty for red diesel often depends on gallons found, the tank capacity vehicle class and whether you repeat violations later.

- States may add separate fees and back taxes to the standard federal fines for using red diesel on public roads

- Inspectors sample tanks on roadsides to check for dye, which remains detectable even after refilling with clear diesel

- What will happen if you get caught using red diesel? You may receive ticket pay fines and face escalation.

Table of Contents

Fine For Using Off Road Diesel

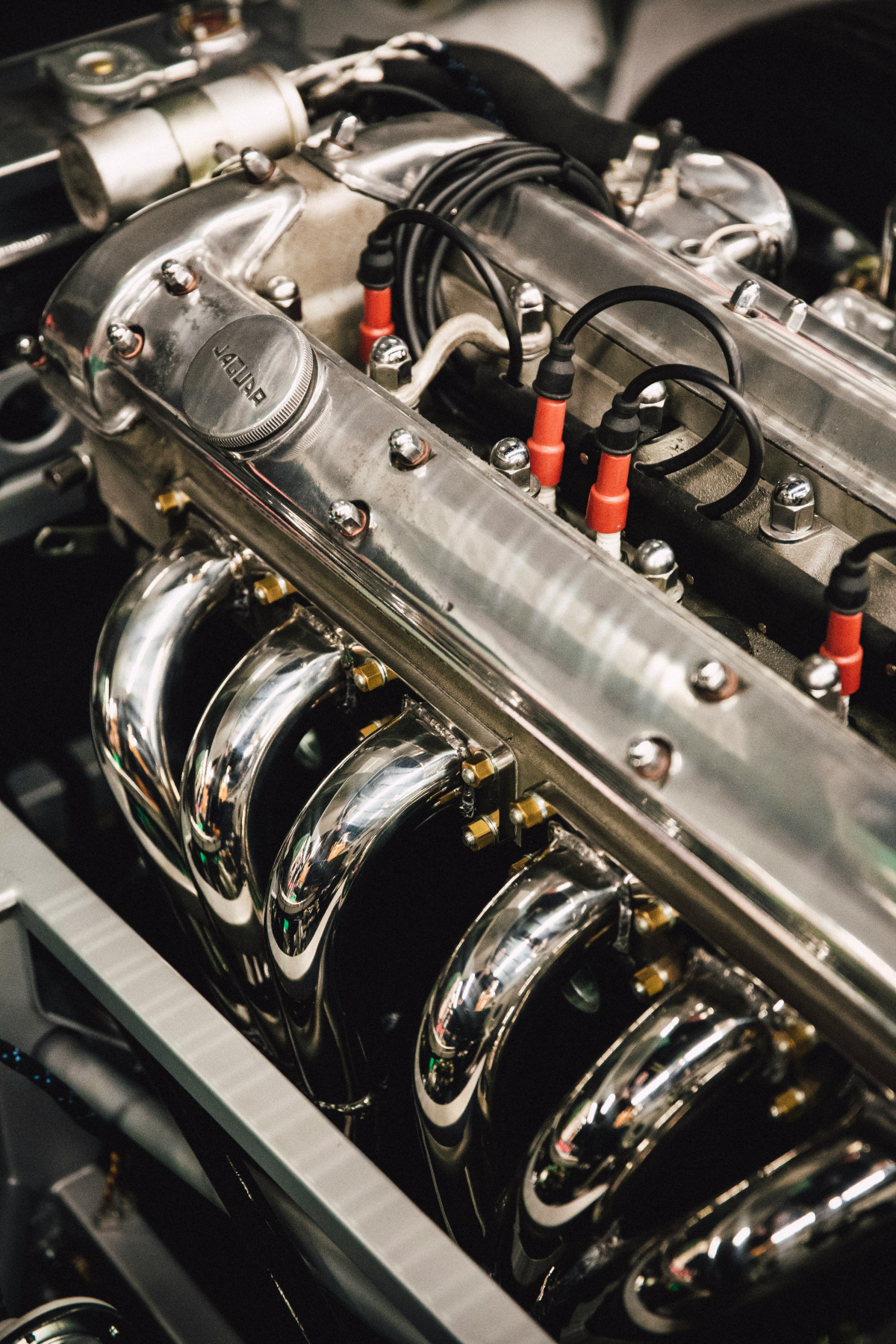

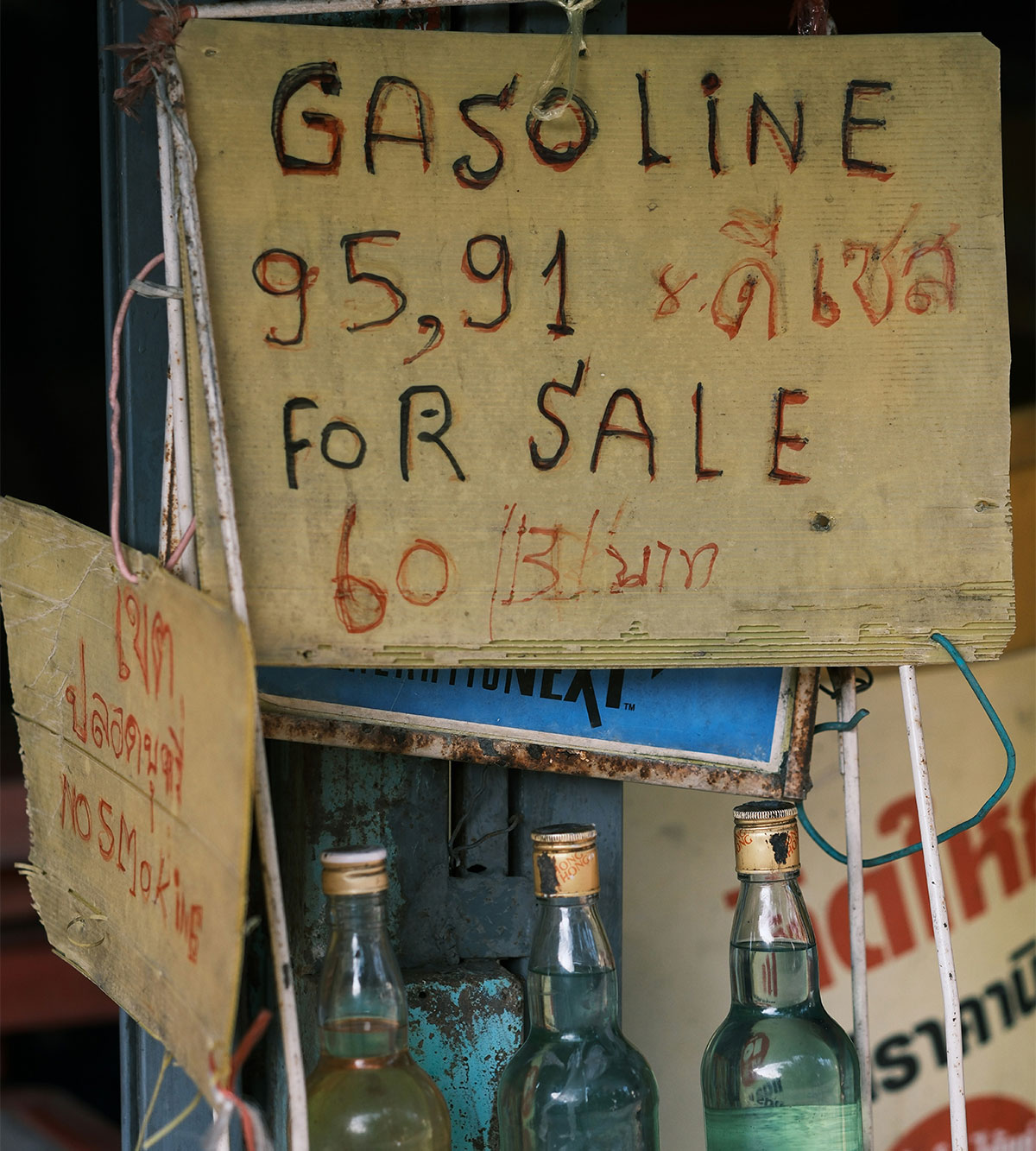

Off-road diesel is fuel identifiable by its red dye, signifying it has been sold exclusively for non-highway applications. This type of fuel is commonly utilized in equipment for sectors like farming, construction, and mining, where machinery does not operate on public roadways. Introducing dyed fuel into a registered highway vehicle carries the substantial risk of a fine for using off road diesel under federal law, often coupled with additional state penalties. Federally, the Internal Revenue Service (IRS) imposes a penalty for dyed diesel used in taxable highway use, set as the greater of $1,000 or $10 per gallon. This rule ensures that even minimal misuse can trigger a significant minimum penalty, while a large fuel tank can lead to very high total fines.

Penalties vary in real cases because enforcement considers factors like these.

- The gallons in the supply tank at the time of inspection

- Whether the vehicle is a personal vehicle or a commercial unit

- Whether this is a first event or a repeat event

- Whether the state law adds its own multiplier or a separate fine

Here is a simple table showing how the federal calculation can work under the IRS rule, which uses the greater of $1,000 or $10 per gallon.

| Dyed fuel gallons found | Dyed fuel gallons found | $1,000 minimum | Estimated federal penalty |

|---|---|---|---|

| 5 | 50 | 1,000 | 1,000 |

| 20 | 200 | 1,000 | 1,000 |

| 75 | 750 | 1,000 | 1,000 |

| 150 | 1,500 | 1,000 | 1,500 |

| 250 | 2,500 | 1,000 | 2,500 |

What’s The Fine For Red Diesel When You Get Caught Driving?

The common question regarding what’s the fine for red diesel often finds its practical answer in a two-stage process: immediate roadside consequences followed by a larger civil penalty. Enforcement begins with a traffic stop, roadside inspection, or a checkpoint. In numerous states, inspectors are legally authorized to take a fuel sample directly from the tank. If dyed fuel is discovered in a vehicle used on public highways, the operator can be cited, essentially being caught using red diesel.

Penalties are frequently tied to vehicle size and tank capacity. Some states calculate the fine based on the vehicle’s maximum tank capacity, rather than just the estimated fuel volume at the time of the stop. For instance, Virginia imposes a civil penalty equal to the greater of $ 1,000 or $ 10 per gallon, using the maximum capacity for calculation, and includes penalties for refusing an inspection. Fines for repeat offenses escalate; federal law increases the base $1,000 portion for multiple violations, making subsequent events significantly more costly than a first offense.

Worried You’ll Get Flagged In A Dyed Fuel Check?

Dyed fuel inspections can happen at roadside stops, weigh stations, and even worksite entry points. Use a quick “risk check” to see how enforcement typically works, what paperwork can help, and the most common mistakes that trigger penalties.

What Is The Fine For Running Red Dye Diesel In A Truck?

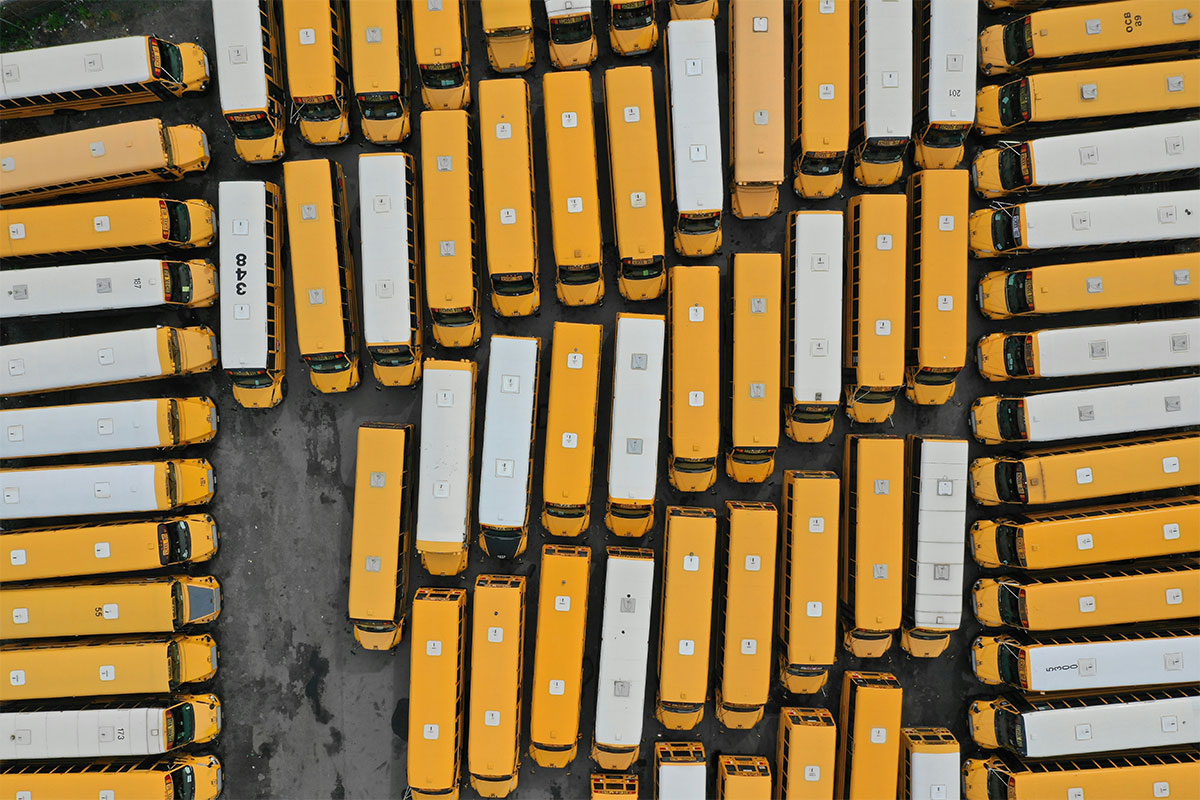

Commercial trucking faces a disproportionately high risk regarding dyed diesel fuel violations due to larger fuel tanks, greater travel distances, and more frequent inspections. Should a commercial unit or even a personal pickup be caught with illegal dyed fuel, it can lead to a severe fine for running dyed diesel or a fine for using dyed diesel. The penalty amount is typically calculated based on the volume of fuel involved and any prior history of violations.

Enforcement also differs between personal and commercial vehicles. While a personal pickup might be inspected following a routine traffic stop, commercial trucks are routinely checked during DOT activities such as weigh stations, roadside safety checks, or compliance inspections. These structured settings significantly increase the likelihood of agencies detecting dyed fuel, which, in turn, raises the chance of receiving a ticket for red diesel. For those legally utilizing off-road diesel for permitted equipment, it is crucial to purchase high-quality fuel from a reputable supplier and maintain clear, matching records.

Can Punishment For Using Red Diesel Include Vehicle Seizure?

Concerns over punishment for red diesel usage often extend beyond simple fines. Typically, the consequence involves a civil penalty along with back taxes. However, enforcement severity can escalate, leading to more serious action when evidence suggests deliberate tax evasion, large-scale misuse, or habitual violations. Vehicle seizure, which is generally tied to state authority, is more probable when there is proof of ongoing fraudulent activity, attempts to remove the dye, or a history of repeat offenses. Federal law also addresses the taxable use of dyed fuel and increases penalties for multiple infractions.

It also helps to understand the difference between seizure and impoundment.

- Seizure often refers to taking property under legal authority tied to the alleged violation

- Impoundment is often a temporary hold of the vehicle, sometimes for safety, sometimes until fees are paid

- Even when a vehicle is not seized, agencies may still detain a vehicle long enough to inspect and sample fuel where authorized

- The stop happens at roadside, a weigh station, or a worksite access point

- An officer or fuel inspector checks the tank area and may look for signs of dyed fuel

- A fuel sample can be taken from the tank, and dye can be visible even in small amounts

- If dyed fuel is confirmed, the driver may be treated as caught with red diesel and a citation can be issued

- The case may then move into an assessment process where the civil penalty and any tax due are calculated

- A notice is sent or given that explains the amount due and how to pay or contest it

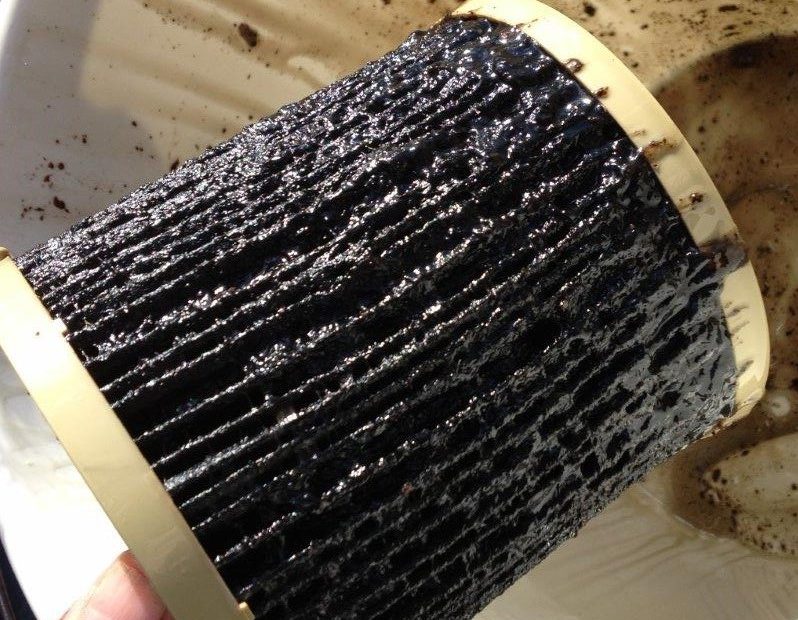

- Visual checks of fuel filters or sample jars for a red tint

- Fuel tank sampling using a small draw from the tank

- Checks at weigh stations and roadside inspection points

- Worksite checks where highway vehicles enter and exit fuel storage areas

- The violation code and the reason for the stop or inspection

- The location, date, and agency that performed the inspection

- A description of the fuel sampling process and findings

- A fine breakdown or a statement that the penalty will be calculated and mailed

- Notes about estimated gallons or tank capacity used for calculations

- Documentation requirements, such as proof of permitted off road use, purchase records, and business records

- The fuel is used in off-highway equipment, not in highway propulsion

- The use matches a tax-exempt purpose under applicable rules

- Records show that dyed fuel was stored and dispensed correctly

- Vehicles that sometimes go on the road use the correct taxed fuel for on-road driving

- Different formulas, such as $10per gallon, or a multiple of the unpaid tax

- Different measurement bases, such as estimated gallons or maximum tank capacity

- Different add-ons, such as separate penalties for refusing inspection

- Different enforcement intensity, with more frequent checks in heavy trucking corridors and at weigh stations

Want To Estimate Your Potential Fine In Minutes?

Federal penalties can be the greater of $1,000 or $10 per gallon, and some states add their own formulas or use tank capacity for calculations. Use a simple estimator to model your scenario and understand why totals can spike fast.

What Happens If You Get Caught Using Off-Road Diesel?

If people ask what happens if you get caught with off road diesel, the typical process is predictable, though exact steps may vary by jurisdiction.

Many jurisdictions specifically describe inspection authority and sampling, and some explain penalties for refusing inspection.

What Happens If You Get Caught With Off-Road Diesel Repeatedly?

The consequences escalate rapidly with repeat violations. If an entity is repeatedly getting caught with red diesel, regulatory agencies may classify this as a pattern of non-compliance rather than an isolated mistake. Federal regulations impose an increase on the standard $1,000 component for multiple offenses, meaning the base penalty for a subsequent violation can be substantially higher before the per-gallon calculation is applied.

Furthermore, a history of repeated offenses may increase the potential for criminal charges in certain jurisdictions, particularly in states where statutes define distinct criminal classifications based on the quantity of fuel involved or in instances of refusal to cooperate with inspectors. For example, documents from Virginia outline criminal classifications linked to quantity in addition to the established civil penalty structure. Enforcement agencies track violations using a combination of prior penalty history, vehicle registration data, inspection reports, and agency-specific databases. Consequently, a repeat fine for running red diesel incident is often treated with greater severity than a first-time offense.

How Do Authorities Catch People Using Red Diesel?

Dyed fuel is specifically designed for easy detection through the addition of a dye. This coloring enables quick identification during enforcement, allowing state agencies and the IRS to differentiate tax-exempt fuel from taxable highway fuel.

Inspection methods often include these.

How Do Cops Know If You’re Using Red Diesel?

To know how do you get caught with red diesel, the simplest answer is that the dye, when used in an engine, will leave residues. This residue will leave a tint in your engine that can remain there for a while even after you have refilled with clear diesel. This makes it easy for law enforcement to detect the use of red diesel to be detected during roadside checks . The sampling and inspection approach is described in state enforcement materials, including authority to extract and keep samples. This is why even a one-time fill can lead to being caught with red diesel outcomes later if the tank and fuel system still show dye.

What Happens When You Are Caught And Issued A Red Diesel Ticket?

A red diesel fine typically begins with a ticket or citation, then proceeds to a civil assessment procedure. The initial roadside document outlines the violation and relevant facts, while subsequent official paperwork will specify the final amount due. These citations usually stipulate a response deadline and may offer the option for payment or, depending on the jurisdiction, an appeal or administrative review. Ignoring such a ticket can lead to escalating penalties, which may include additional fees, collection actions, or consequences for vehicle registration, all governed by local law.

What Does A Ticket For Red Diesel Usually Include?

A ticket for red diesel includes the following.

In some states, penalties can apply not only to the propulsion tank but also to related storage tanks if they are involved in the source of the dyed fuel.

Why Is Off Road Diesel Illegal For On-Road Use?

The primary reason for regulating dyed diesel is rooted in the tax structure. Dyed diesel is typically sold for uses that qualify for exemption from certain highway fuel taxes. This tax structure exists because highway taxes are specifically intended to fund road construction and maintenance. Therefore, when dyed fuel is used on the road, it is viewed by the government as an avoidance of the tax paid by other drivers. Consequently, the misuse of dyed fuel is often treated as tax evasion rather than a minor equipment violation. Federal regulations mandate significant penalties for the use of dyed fuel in taxable highway applications, and the IRS provides clear explanations of this penalty structure.

Get Inspection-Ready Records Before You Need Them

If your dyed diesel use is legal (off-highway equipment), clean documentation is your best protection when questions arise. Grab a checklist and log template for invoices, delivery tickets, and usage tracking so your records match your permitted use.

When Is Using Off Road Diesel Legal Or Allowed?

Off-road diesel can be legally used in any operation that doesn’t involve a public road or highway. All off-road activities that do not require highway passage are considered appropriate for red diesel use.

Allowed usage often depends on the following facts;

-

Documentation matters. Keeping invoices, delivery tickets, and usage logs can help show lawful use if questions arise.

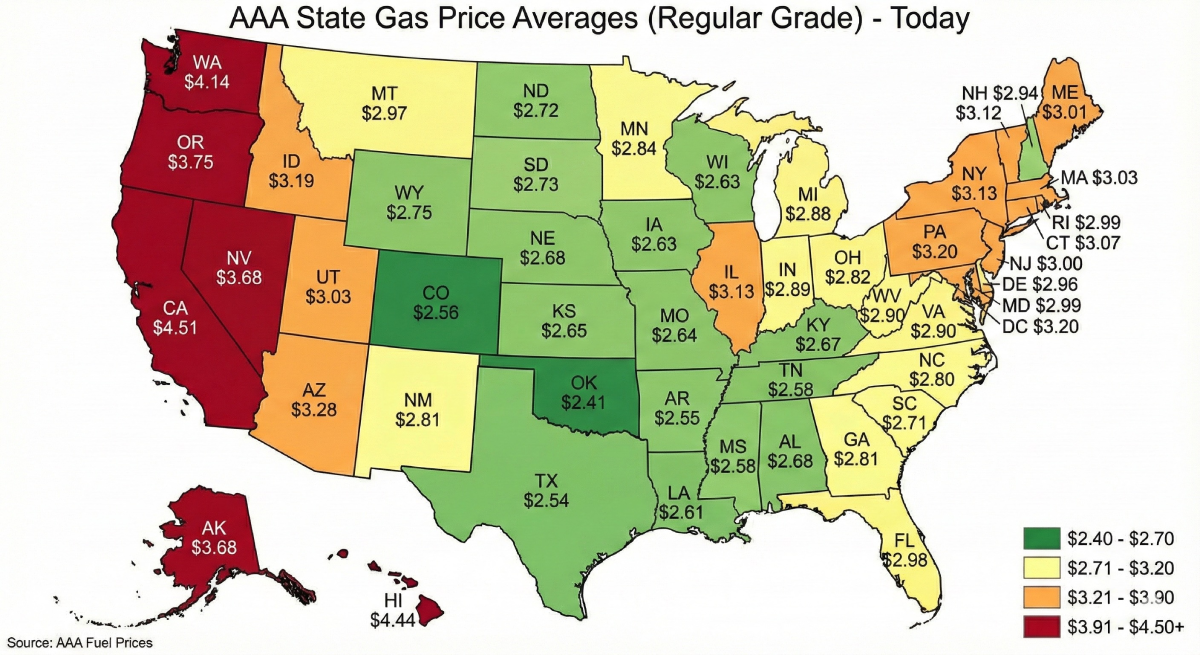

How Do Fines For Using Off Road Diesel Vary By State?

States have the authority to impose penalties for fuel violations that exceed or differ from federal regulations, often using varied calculation methodologies. For instance, some states, like Virginia and Georgia, mirror the federal penalty structure by setting a civil fine as the greater of $1,000 or $10 per gallon, with Virginia basing this on the maximum tank capacity. Georgia applies this specifically to dyed fuel oil in certain situations.

Conversely, other states employ distinct formulas. North Carolina, for example, determines the penalty as the greater of $1,000 or five times the amount of motor fuel tax payable on the fuel within the supply tank. Despite these variations, the federal penalty structure established by federal law and IRS guidance ensures that minimum fines are consistently applied nationwide whenever federal enforcement is involved.

Here are the main ways state variation shows up.